The problem with busines cases are usually not the calculations but in the underlying assumptions. There is also the lack of independence factor that will find a way to make the models and statistics work in a favourable way.

What is included in a business case?

A business case usually contains a number of sections, including executive summary, objectives, methodology, cash flow, return on investment (ROI), assumptions, in-tangible benefits and recommendations, as well as appendices for the preliminary work done, such as a business process review and the request for proposals.

Independence is Key

Sometimes the compelling business case in project management is you don’t have a choice. For example, your existing system is no longer supported or your business has changed. Still, there could be a big spread between the low and high end of the potential solutions. How do you justify the higher end solution if that is the one you think is best for your company? You will often find the vendor/solution provider willing to help you with a business case. But do you think you are getting unbiased help? So you ask the same people that will be involved in the project to prepare the business case. Although their lack of independence is not as glaring as the vendor/solution provider, it is still a big problem as they may have lots to gain if the project goes through. They are unlikely committing fraud in developing a business case, but they are likely to be overly optimistic in their eagerness to proceed.

Confusion

Another big problem is that there is a lot of confusion about how to do a business case. Many of those building the business case don’t have relevant training or experience. Further, even if they do have the experience, it’s tricky. The basic calculations, such as ROI and NPV, are not difficult. But how do you convert the intangible benefits into numbers? It’s not just the benefits you need to worry about. Some costs are very easy to identify but there may be missing costs from the calculations which would include the internal costs related to the project. You need to include what is often called the ERP Total Costs of Ownership.

Tangible Benefits

Let’s start with the easy benefits. You need to understand the bottlenecks in your organization and how much time will be saved if the ERP project proceeds. This requires a careful review of business processes. In some cases, there may be savings because there are fewer employees. However, that does not often happen. More frequently, these people end up doing their work more efficiently and can focus on other activities. The results are usually that the company can grow at a rapid rate without hiring additional administrative resources.

If the investment is in an ERP system, you will often hear about significant reductions in inventory. This provides not only a one time reduction in assets (and improved cash flow) but also provides on-going savings in the carrying costs associated with the inventory which would include interest, warehousing, handling, obsolescence, insurance and shrinkage. A good system has the computing power to reduce inventory by recommending purchases only when necessary based on factors including inventory levels, customer demand and lead times. However, these inventory reductions are not always realized because the computer system will not work properly unless there is the discipline to set it up right and maintain it properly. You should talk to other companies about their experiences to see whether the numbers are realistic. You should ensure that your employees agree to the targets and you should also be conservative.

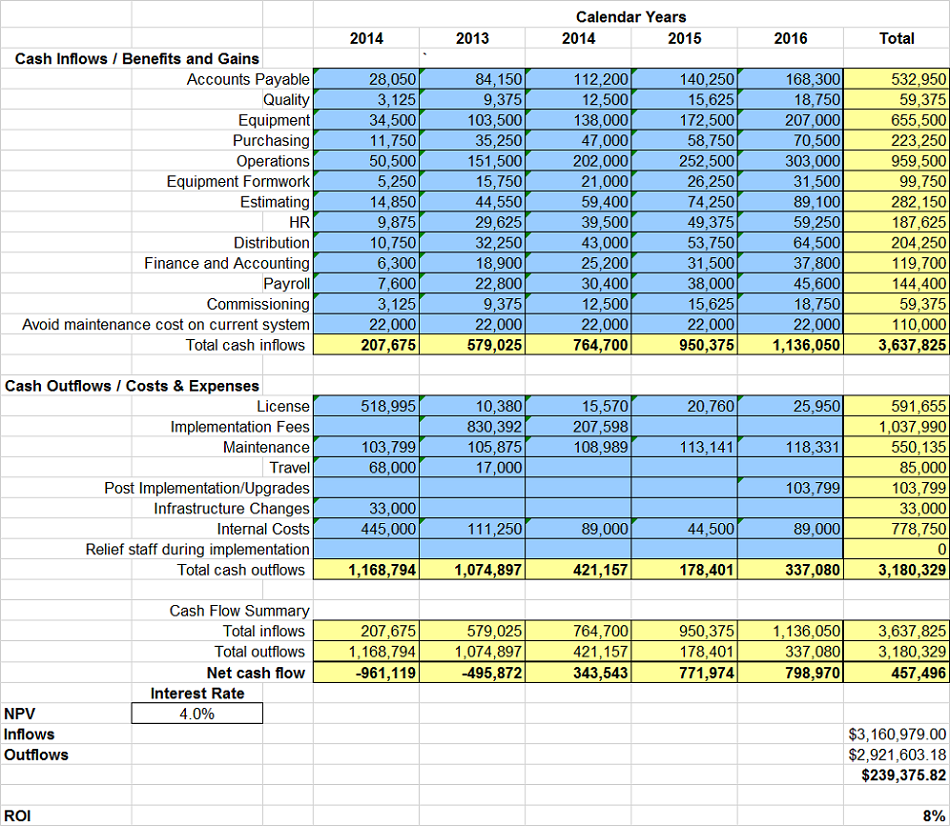

Sample ERP Business Case in Project Management

Negative ROI

Don’t be surprised by a negative ROI. In fact, don’t believe anyone who says you will get a positive ROI when you select a new system. That is because many of the benefits are intangible. For example, suppose you want to improve the decision-making process. With a new system you might be able to reduce the time needed to prepare the reports — and this can be calculated. But it’s impossible to calculate the benefits of making better decisions without making wild guesses.

An Alternative

One way to achieve some perspective is to divide the ROI by the number of people in the organization. A better way is to analyze the impact of the new system against the organization’s critical success factors (CSFs) — what it must do well in order to succeed. To see whether the CSFs have been attained, key performance indicators (KPIs) are used.

An improvement in the KPIs can be used to show the benefit of the investment. For example, a public financial-services company might currently take 10 days to issue financial statements. The new system will allow the company to issue the financial statements in two days. Or a distributor currently takes on average three days to ship an order. The new system will allow the company to ship the order in one day. Management needs to assess whether the investment is justified based on these improvements.

Don’t Forget About It

Some companies do a decent job in preparing the business case but when the investment is approved, promptly forget about it. The business case, and especially the KPI goals, should be kept on hand to measure the success of the investment. Don’t celebrate when the system is on time or on budget. Break out the champagne when your KPI goals have been realized.